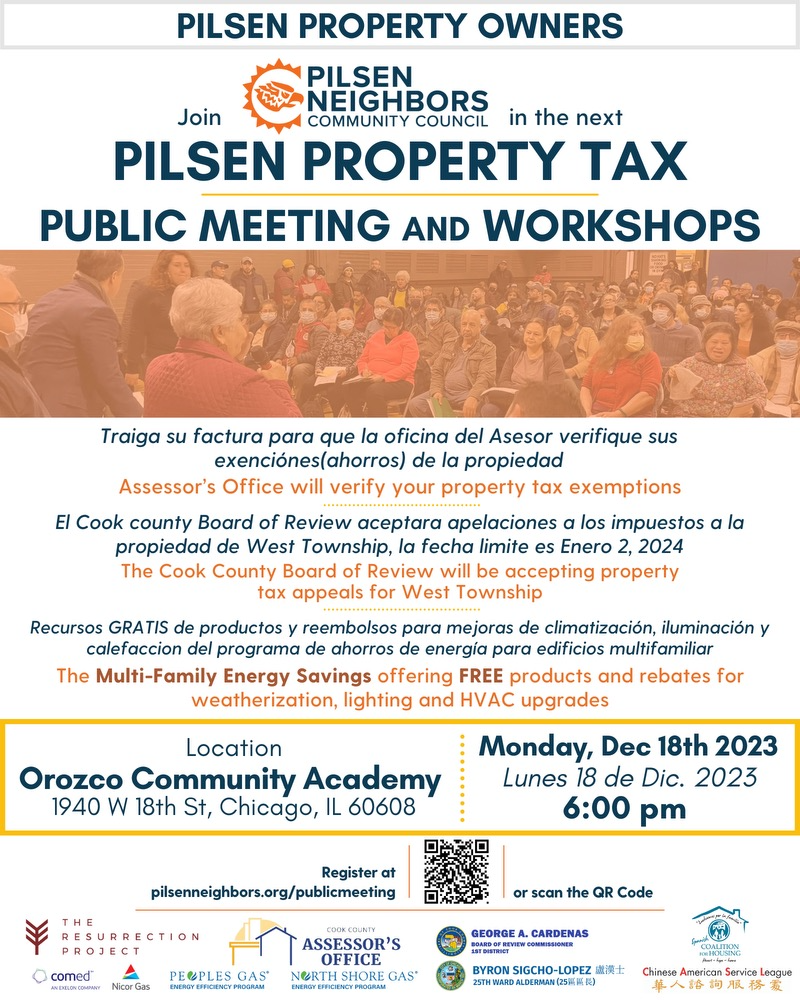

Property Tax Town Hall

Join the Cook County Asessor and the Board of Review for an update on the fight against property taxes. Monday, December 18th at 6:00 pm

Join the Cook County Asessor and the Board of Review for an update on the fight against property taxes. Monday, December 18th at 6:00 pm

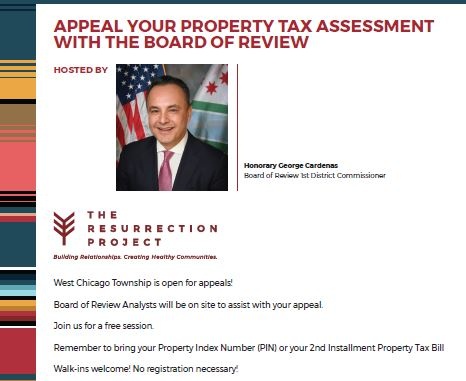

Deadline for property tax appeals is January 2nd! Don't miss out on saving money! Free support service center! NO COST and NO RESERVATION NEEDED

Please help us support homeless families across the Chicago area who are seeking secure housing! Please consider donating various items for our new neighbors, new arrival immigrant families, and individuals […]

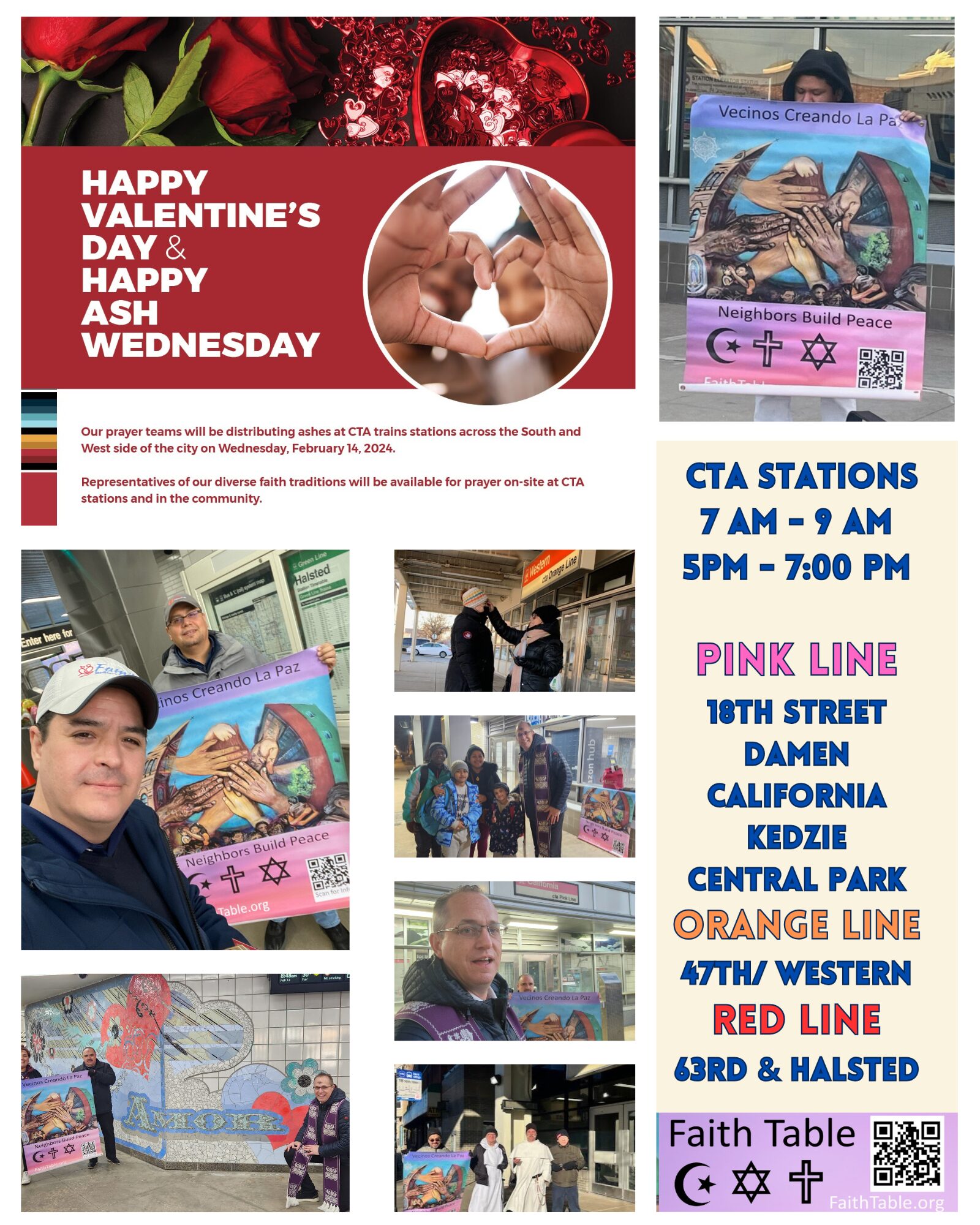

FAITH TABLE INTERFAITH COALITION KICKS OF THE NEW YEAR 2024 TOGETHER! JOIN US!

JOIN FAITH TABLE INTERFAITH COALITION PARTNERS FOR A PRAYER, A BLESSING AT CTA TRAIN STATIONS ON CHICAGO'S WEST SIDE WHEN: 7;00 AM TO 9:00 AM and 5:00 PM TO 7:00 […]

You are invited to be part of West Chicago’s Property Tax Campaign hosted by St. Procopius & The Resurrection Project. Housing counselors will provide information on: Triennial reassessment, Exemptions, Provide […]

You are invited to be part of West Chicago’s Property Tax Campaign hosted by St. Paul & The Resurrection Project. Housing counselors will provide information on: Triennial reassessment, Exemptions, Provide […]

You are invited to be part of West Chicago’s Property Tax Campaign hosted by St. Paul & The Resurrection Project. Housing counselors will provide information on: Triennial reassessment, Exemptions, Provide […]

You are invited to be part of West Chicago’s Property Tax Campaign hosted by St. Paul & The Resurrection Project. Housing counselors will provide information on: Triennial reassessment, Exemptions, Provide […]